What is the Hornsdale Power Reserve

The Hornsdale Power Reserve, also known as the “mega battery” complex, is a partnership between the South Australian (SA) government and Neoen, a French renewable energy company. It is located alongside the Hornsdale Wind Farm.

The battery has a generation capacity of 100 megawatts and can store 129 megawatt-hours of energy. It has been described as having the ability to power 50,000 homes and provide 1 hour and 18 minutes of storage, although there is controversy over the actual storage time, which some argue is only 2.5 minutes.

The battery complex consists of two systems. The first system, contracted to the SA government, has an output capacity of 70 megawatts and about 10 minutes of storage. It is primarily responsible for grid stability and system security.

On Friday December 1, the “world’s largest†lithium-ion battery was officially opened in South Australia. Tesla’s much anticipated “mega-battery†made the “100 days or it’s free†deadline, after a week of testing and commissioning.

Unsurprisingly, the project has attracted a lot of attention, both in Australia and abroad. This is largely courtesy of the high profile Tesla chief executive Elon Musk, not to mention the series of Twitter exchanges that sparked off the project in the first place.

Many are now watching on in anticipation to see what impact the battery has on the SA electricity market, and whether it could be a game-changer nationally.

The Hornsdale Power Reserve

The “mega battery†complex is officially called the Hornsdale Power Reserve. It sits alongside the Hornsdale Wind Farm and has been constructed in partnership with the SA government and Neoen, the French renewable energy company that owns the wind farm.

The battery has a total generation capacity of 100 megawatts, and 129 megawatt-hours of energy storage. This has been described as “capable of powering 50,000 homesâ€Â, providing 1 hour and 18 minutes of storage or, more controversially, 2.5 minutes of storage.

At first blush, some of these numbers might sound reasonable. But they don’t actually reflect a major role the battery will play, nor the physical capability of the battery itself.

What can the battery do?

The battery complex can be thought of as two systems. First there is a component with 70MW of output capacity that has been contracted to the SA government. This is reported to provide grid stability and system security, and designed only to have about 10 minutes of storage.

The second part could be thought of as having 30MW of output capacity, but 3-4 hours of storage. Even though this component has a smaller capacity (MW), it has much more storage (MWh) and can provide energy for much longer. This component will participate in the competitive part of the market, and should firm up the wind power produced by the wind farm.

In addition, the incredible flexibility of the battery means that it is well suited to participate in the Frequency Control Ancillary Service market. More on that below.

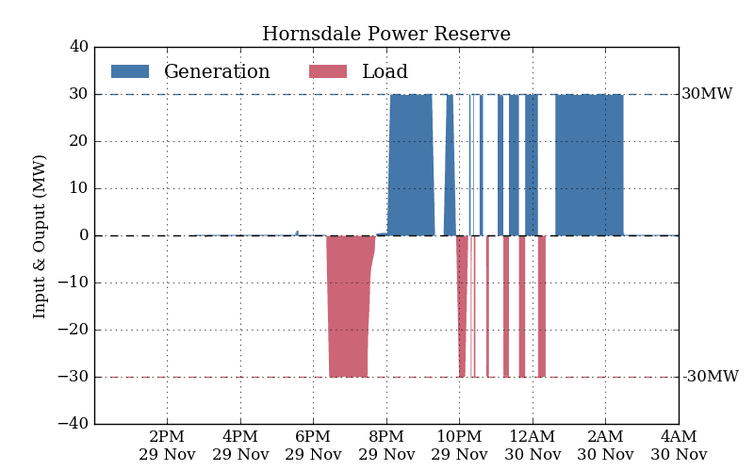

The figure below illustrates just how flexible the battery actually is. In the space of four seconds, the battery is capable of going from zero to 30MW (and vice versa). In fact it is likely much faster than that (at the millisecond scale), but the data available is only at 4-second resolution.

Author provided (data from AEMO)

Frequency Control and Ancillary Service Market

The Frequency Control and Ancillary Service (FCAS) market is less known and understood than the energy market. In fact it is wrong to talk of a single FCAS market – there are actually eight distinct markets.

The role of these markets is essentially twofold. First, they provide contingency reserves in case of a major disturbance, such as a large coal generation unit tripping off. The services provide a rapid response to a sudden fall (or rise) in grid frequency.

At the moment, these contingency services operate on three different timescales: 6 seconds, 60 seconds, and 5 minutes. Generators that offer these services must be able to raise (or reduce) their output to respond to an incident within these time frames.

The Hornsdale Power Reserve is more than capable of participating in these six markets (raising and lowering services for the three time intervals shown in the illustration above).

The final two markets are known as regulation services (again, as both a raise and lower). For this service, the Australian energy market operator (AEMO) issues dispatch instructions on a fine timescale (4 seconds) to “regulate†the frequency and keep supply and demand in balance.

The future: fast frequency response?

Large synchronous generators (such as coal plants) have traditionally provided frequency control, (through the FCAS markets), and another service, inertia – essentially for free. As these power plants leave the system, there maybe a need for another service to maintain power system security.

One such service is so-called “fast frequency response†(FFR). While not a a direct replacement, it can reduce the need for physical inertia. This is conceptually similar to the contingency services described above, but might occur at the timescale of tens to hundreds of milliseconds, rather than 6 seconds.

The Australian Energy Market Commission is currently going through the process of potentially introducing a fast frequency response market. In the meantime, obligations on transmission companies are expected to ensure a minimum amount of inertia or similar services (such as fast frequency response).

I suspect that the 70MW portion of the new Tesla battery is designed to provide exactly this fast frequency response.

Size matters but role matters more

The South Australian battery is truly a historic moment for both South Australia, and for Australia’s future energy security.

![]() While the size, of the battery might be decried as being small in the context of the National Energy Market, it is important to remember it’s capabilities and role. It may well be a game changer, by delivering services not previously provided by wind and solar PV.

While the size, of the battery might be decried as being small in the context of the National Energy Market, it is important to remember it’s capabilities and role. It may well be a game changer, by delivering services not previously provided by wind and solar PV.

Dylan McConnell, Researcher at the Australian German Climate and Energy College, University of Melbourne

This article was originally published on The Conversation.